☕ What’s next for markets, Robinhood, bitcoin and gold

Feb 09, 2026Good morning! 👋

The markets are down yet again this morning but critically, still strong under the hood.

I think that’s a huge vote of confidence in what happens next, just not immediately.

My gut tells me they could be green by the time you read this… at least the S&P 500 and the Nasdaq, anyway. Whether they stay that way is another matter.

Think about it.

Roughly 59% of S&P 500 companies have reported with 76% of which have reported positive EPS surprises and 73% have reported positive revenue surprises, according to FactSet. (Read)

Better still, the blended year-over-year earnings growth rate for the index is tracking at 13% for Q4 2025 — which, if it holds, would mark a fifth consecutive quarter of double-digit earnings growth. Also according to FactSet.

Buyers wouldn’t be taking up the slack if they were really worried.

Buy the best, ignore the rest!®

Here’s my playbook.

1 – What’s coming next in the markets?

I sat down this morning with the super-savvy Ashley Webster who asked me some very insightful questions about what’s next for markets, Bitcoin, Robinhood earnings, and gold. (Watch)

I think we’ve still got a lot of leverage in the system, which is why I expect a bit more “blender-like” action this week and why I continue to believe it’s an opportunity.

Keith’s Investing Tip: Investing is only complicated if you make it that way.

2 – Meta’s legal reckoning begins, “not our problem meets the jury”

New Mexico is suing Meta and the trial starts today over allegations that Meta failed to safeguard apps like Facebook and Instagram from online predators who targeted child users. (Read)

At the same time, a jury is being empaneled in Los Angeles for a separate trial over allegations that Meta, YouTube, TikTok and Snap failed to tell the public about the safety of their social media and video streaming apps even though all companies knew that the designs and features were harmful to the mental health of young users. (Read)

Meta, of course, denies the charges.

Social media companies have hidden behind Section 230 Provision of the Communications Act claiming content shared on their apps is protected but what makes these suits different is that they are very narrowly defined.

The idea that Meta can control advertising to the pixel yet isn’t responsible for the content, the design and the harm that comes from those who misuse its services is patently ridiculous when it comes to criminal behavior.

The court systems need a wakeup call.

I’ll be watching very closely for two reasons.

First, we don’t need more regulation, but what we do need is legal accountability for improper, criminal behavior flourishing on social media and on Meta, in particular. It’s a cesspool and the company’s own internal documents show perhaps $16 billion dollars worth of revenue come from fraudulent and scam related sources.

Second, there is a nasty bunch of criminal impersonators who are using stolen images, my likeness and biological information, copyrighted materials and more as part of a scam they call Dividend & Compound Investing Group.

My counsel and I have repeatedly notified Meta/Facebook, yet they won’t take it down because they are apparently willing to let 28,000+ Facebook users fall victim to the schlock to whatever criminal and fraudulent activities they’re hocking.

Sadly, the courts don’t have the courage to stand up even though the Section 230 strips Meta of immunity once they know improper activity is taking place, and Facebook’s own policies prohibit that behavior.

But back to the matter at hand.

These suits could change that and not a moment too soon, imho.

Trade Idea: A few speculative puts might be interesting if the legal winds start to blow against El Zucko and crew. Longer term, Wall Street has every incentive to defend the stock, so it’s probably good for $1,000 a few years from now anyway. 🙄

3 – Robinhood reports Tuesday… and the house still gets paid

Robinhood reports on Tuesday after the bell. (Read)

Like many, I’ll be keen to see how it’s impacted by the latest crypto selloff. With shares off ~25% YTD, I could make the case for a run higher… if the numbers play out.

Wall Street’s spreadsheet gang expects EPS of $0.62-3 per share, roughly 15% YoY growth. Revenue may be double that at $1.32-1.35B or 30%. Then there’s gold subscription growth, funded account metrics and, again, transaction-based revenues which are usually a mirror of crypto volatility.

I don’t own it and won’t because I don’t like the business model. Selling customers out just doesn’t sit well with me; ~56% of trailing 12-month revenues – roughly $2.34B of $4.20B - of revenue comes from PFOF (Pay for Order Flow).

You didn’t really think all those “free” commissions were really free did ya? 🙄

Trade Idea: Given recent short-term trading conditions, I’d consider shorting or buying puts into earnings if the stock is rising late Tuesday. Then a quick exit if the afterhours gang drives it lower overnight. If the stock drops into the closing bell, the opposite is true and buying or selling near term cash secured puts the morning after could be a smart move.

Keith’s Investing Tip: If you don’t know how a company gets paid, assume that you’re the product!

4 – Novo Nordisk goes for the jugular

This is interesting. (Read)

Normally companies with big patents are protected but there’s a loophole that allows copycats to sell compounded versions of patent-protected drugs when branded treatments are in short supply.

However, Semaglutide — the active ingredient in Novo’s pill and its blockbuster injections — is no longer in shortage in the U.S., thanks to the company’s efforts to ramp up manufacturing capacity.

What catches my attention though is that Novo is saying that Hims & Hers version is untested, so they’re evidently going right for the jugular vein saying they’re unsafe.

Why?

Because that’s the one area US courts won’t take for granted.

I’d rather own the IP, the scale and the distribution in a case like this which, if it hits hard, won’t be the last.

One of my faves, btw, a key patent holder in all sorts of medicines, has returned ~153.72% over the past 5 years versus the S&P 500 which has turned in ~77.48% over the same time frame. Oh, and ~105.81% better than NVO over the same time frame, btw.

Hopefully you’re thinking along similar lines in your portfolio. If not and you’d like some help along with a model portfolio that I think makes the proverbial cut, I’ll be here.

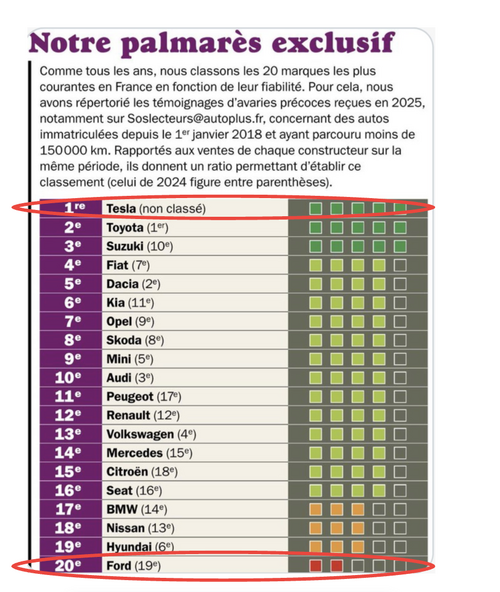

5 - Les rageux de Tesla vont s’étouffer avec leur baguette ce matin

France’s most-read car rag – Auto Plus – just dropped their 2026 reliability ranking (based on real 2025 owner breakdown data, adjusted for sales).

And guess who’s sitting pretty at N°1 overall having beaten the entire dang field?

Tesla.

The one maker many swore up, down and sideways that “nobody” wanted and wasn’t worth a hill of beans.

Popcorn time – you know what to do.

I hope!

Tesla has a dozen different catalysts ahead this year and Elon is now talking $100T which makes the $20T I said a while ago look like child’s play. And he, btw, loved my take!

Long Tesla and continue to short/avoid Ford.

Bottom Line

People are so busy trying to predict the unpredictable that they forget to think about the profitable.

Now and as always, let’s MAKE it a great day and start the week strong.

You got this – I promise!

Keith 😀