☕️ Time to bet on Intel? DeepSeek strikes again

May 29, 2025Howdy 👋

Nvidia set off a worldwide rally that appears to have legs, at least for the morning and at least as I type. I am not sure that a legal challenge to US President Donald Trump’s tariffs will carry the day though, but that’s neither here nor there.

We do money, not politics.

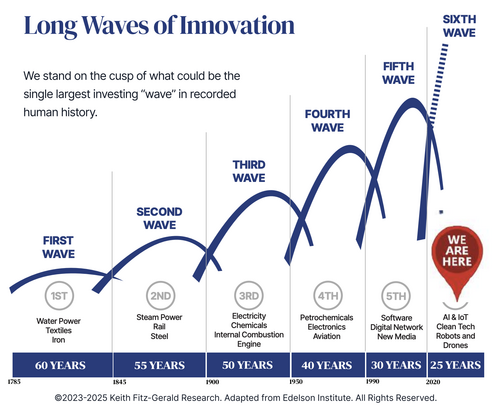

What you want to do is look right through this stuff and focus on what you know to be true… that there is immense profit potential being created.

Always remember.

Profits are always the currency of success.

Here’s my playbook.

1 – Nvidia’s home run

It was an honour to talk about Nvidia’s latest results with my friend and colleague, the super sharp Richard Dean on Dubai One and Dubai Eye.

Clearly another home run with HUGE implications for the rest of the industry. Not to mention a global chip rally as I type.

- Revenue of $44.1 billion, +69% YoY

- Data center revenue of $39.1 billion, +73% YoY

- Net income of $18.8 billion, +26% YoY

We also touched on a few other key topics, too.

Hope the perspective helps! (Watch)

What’s next?

That’s the big question and it’s not so much about the companies as it is about what investors like us – yep, you and me – will do about it.

There are a lot of people who are still sitting on the sidelines grousing about valuations etc… and who are getting left even farther behind.

Good on ‘em for standing by their convictions but there’s a very good case that’ll cost ‘em dearly.

Nvidia has returned ~26,348% and ~67,337% over the past 10 and 20 years – enough to turn every $1,000 into $264,480 and $674,370 respectively.

Life-changing wealth.

If you can throw that kind of profit potential away, good on you – most investors cannot.

Just sayin’.

Keith’s Investing Tip: It’s time to fish or cut bait, as my great grandfather would say. You may not be able to control valuations but sure as heck, you can control risk by using the right tactics. Get to it!

2 – Time to bet on Intel?

Newly seated CEO Lip-Bu Tan has a long track record but Intel has no customers, or at least not a big monster on the line – think Apple, Qualcomm or Nvidia – for example - capable of pulling the company outta the pit it dug for itself. (Read)

Tan has a tough row to hoe.

Intel put the silicon in Silicon Valley but now struggles to remain relevant in an increasingly dominated AI world.

Might be worth a few speculative calls or LEAPs.

Hmmm.

3 – E.l.f makes Hailey a billionaire

I am not crazy about the whole celebrity thing, but I love it when folks turn their dreams into reality with a lot of hard work.

This time around it’s Hailey Bieber, a model and entrepreneur married to singer Justin Bieber.

E.l.f, the cult-favorite cosmetics brand, is buying Hailey Bieber’s Rhode for up to $1B—its biggest acquisition ever. (Read)

The move slaps a bold exclamation point on E.l.f.’s pivot into skincare, where Rhode was the #1 brand in earned media value last year.

Translation?

Massive influence, minimal spend.

I think it’s got a great shot at serious profitability.

Bieber apparently staying on board as Chief Creative Officer and Head of Innovation, keeping the brand’s Gen Z halo intact.

E.l.f. also crushed Q4 earnings—but, like many companies lately, withheld forward guidance thanks to tariff uncertainty.

Wall Street flinched at first, but shares reversed fast and popped more than 9% premarket Thursday.

Hmmm.

Keith’s Investing Tip: Many investors get set in their ways but those who really make it to the top rung of the ladder learn to recognize unconventional opportunities when they pop up.

4 – China's DeepSeek just launched a stealth upgrade

Beijing’s AI darling just dropped a stealth upgrade to its R1 reasoning model on Hugging Face, an open-source Python library providing pre-trained AI models.

No press release, no fanfare—just cold, calculated advancement. (Read)

Talk about catnip.

This is the same DeepSeek that pulled off the greatest single industrial espionage coup in human history and in plain sight at that.

It rattled Silicon Valley and, in fact, much of the world, earlier this year with a faster, cheaper, open-source model that punched above its weight and walloped OpenAI and Meta in benchmark tests.

The new version?

It's just behind OpenAI’s best on LiveCodeBench—and once again, it’s raising serious eyebrows.

This shouldn’t even remotely be a surprise.

I told you point blank that the Chinese AI scene isn’t operating in isolation like the West thinks.

In fact, they’re leveraging U.S. tools, know-how, and wide-open-source models like a Viking at an all you can eat buffet. One of their favourites is a technique called “distillation” to siphon capabilities from larger models and compress them into smaller, faster-to-train alternatives.

Once again, the West built the tech, then gift-wrapped it with “open access.”

China said, “thank you” … then got to work.

Keith’s Investing Tip: Ignore these developments at your own risk. This isn’t about who’s got the flashiest demo. It’s about control over the future of intelligence. Tech is speeding up—if your portfolio isn’t keeping pace, it’s falling behind.

Btw, I’ve got a few ideas including one that could benefit nicely from the situation at hand. I’ll be sharing that tomorrow in the June issue of One Bar Ahead® if you’re interested. (Learn more)

The last time I saw something similar it led to triple digits and a very complimentary choice that I believe is a global blue-chip in the making.

5 - Dinosaur juice isn’t dead—OPEC+ just hit the gas.

Eight oil-producing heavyweights—including Saudi Arabia, Russia, and the UAE—are eyeing a 411,000 barrel-per-day production hike in July, continuing their steady unwind of voluntary output cuts. (Read)

That’s on top of a million-barrel ramp-up already underway across Q2.

Why now?

Summer demand is coming: jet fuel, road trips, air conditioning.

More oil gets burned—literally.

Despite all the talk about EVs and clean energy, crude still powers the world which is, ta da, why prices are firming as a result.

Don’t make the mistake of counting out fossil fuels just yet.

The energy transition is real—but so is the global addiction to oil.

Smart investors play both sides.

Don’t forget that many of the world’s top oil companies pay fabulous dividends, too.

Bottom Line

Spoiler alert.

The world will change with or without your approval.

So will the financial markets.

Focus on what you can control - tactics, timing, which stocks you buy etc - instead of worrying about what you can't.

As always, let’s MAKE it a great day!

You got this – I promise!

Keith 😀