☕️ $16 trillion later and the doom patrol is still wrong

Oct 03, 2025Howdy! 👋

Today is one of those days where the headlines are full of negative nellies.

For example…

- CNBC is reporting that Goldman’s head honcho, David Solomon, is warning about a stock market drawdown and “people won’t feel good.”

- Not to be outdone, Chicago Fed President Goolsbee is “a little wary” about cutting rates too quickly according to Reuters.

- The Financial Times highlights how multinationals race ahead even as a dollar slump “divides US stock market.”

Don’t let it faze you.

The S&P 500 has jumped nearly 40% and gained roughly $16 TRILLION in value since April 8th.

Could it fall?

Sure.

That’s how the markets work.

Here’s what you really want to think about.

This could be another “Templeton Moment” and I’d hate to see you miss it.

Let me explain.

Back in 1939, on the eve of WWII – when headlines were every bit as dire as today’s – the late Sir John Templeton did something that’s now the stuff of legend.

He famously purchased 100 shares of every company trading on the NYSE for less than $1, including 34 companies that were already bankrupt.

A few years later, he sold all but 4 for ginormous profits.

Templeton refined that philosophy – what he later called “buying into points of maximum pessimism” – and is now regarded as one of the greatest investors of all time.

A $10,000 stake in his Templeton Growth Fund when it launched in 1954 grew to more than $2 million by the time he sold it to the Franklin Group in 1992.

That’s a compound annual growth rate (CAGR) of about 15% and absolute growth of ~19,900% give or take. To put that in perspective, the S&P 500’s long-term average is closer to 9–10% — meaning Templeton’s choices compounded at nearly twice the market’s pace for almost four decades.

The point I want to make is this.

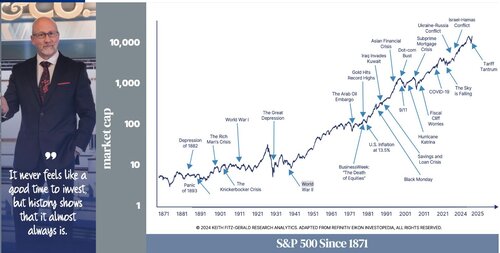

Every dip, every crash, every headline of doom looks huge in the moment… but the market’s long-term trajectory is unmistakable.

Up and to the right.

💡Innovation never stops and neither do the profits that come with it. 💡

I cannot overstate how important this concept is to your investing success.

Most investors play not to lose, and it holds ‘em back because they’re constantly framing every headline, every conversation, every social post because they fear the worst.

The world’s most successful investors flip that around and focus on success because they plan for the best.

That’s why I constantly encourage you to take a page from their playbook and, not for nothing, why One Bar Ahead® is built the way it is.

There is one universal truism when it comes to money.

Missing opportunity is always more expensive than trying to avoid risks you can’t control.

Keith’s Investing Tip: On days like today, I find that turning off the TV, stepping away from the screens, social media and the nonsense make a huge difference. I can think clearly, focus better and plan my next moves more efficiently. I’ll often go for a long walk with my bride or perhaps enjoy a motorcycle ride, too. Give yourself permission to relax, your portfolio will like it. 👏

On a related note, it’s issue Friday!

If you’re a member of the One Bar Ahead® Family, you know what that means. 💯

Keep an eye on your email for the October issue which will be published later today.

I’ve got a new recommendation in a space that I’ve been itching to make but haven’t because the hype has been too high. Now, that’s dying down which means the timing could be perfect… just like it was for several other key names we’ve followed over the years, chief amongst which are Palantir and Nvidia.

There’s also a look at 6 skills to master for staying in winners longer (instead of selling out prematurely and missing a big run like a lot of investors do much to their regret). Almost nobody talks about that, but more investors probably should.

There’s also the portfolio review, a new fascinator and a look at something I’ve discovered that could be the original fountain of youth according to the latest research. That’s key because a strong body + a strong mind = strong results! 😀

Bottom Line

You attract the energy you give off.

Invest in optimism and attract profits.

Good vibes and positivity are contagious.

As always, let’s MAKE it a great day and finish the week strong.

You got this – I promise!

Keith 😀